The relationship between shares and tokens

In this article I look at the differences between equity and tokens when a company wishes to raise working capital and have produced a short 3 minute video introducing the basic concepts.

I also introduce a hybrid model since in a previous article I had suggested the possibility of combining token sales and private equity in order to get the benefits of both and eliminate some of the problems.

Sale of shares

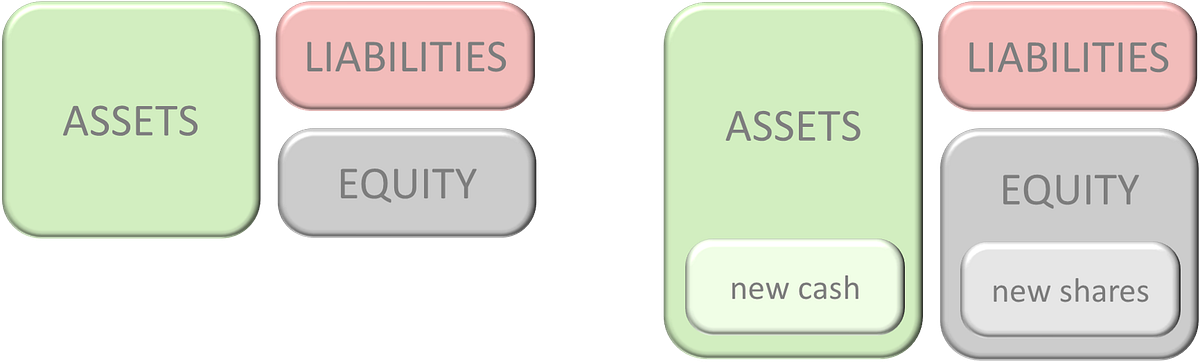

In the case of a company issuing shares in the form of equity. A company’s value is equal to its assets minus its liabilities and this worth is owned by the shareholders — represented by the equity. This is shown below where a company raises new cash by issuing new shares.

Note that the value of the existing shareholders equity does not change with the issue of new shares although their percentage of ownership (and their voting power) is decreased. The above diagrams are a simple representation of what happens to the company balance sheet in a equity funding round. The hope of investors is that the company will grow and so their equity will increase in value. In order to realise this value the equity would need to be sold and this is typically done when there is a trade sale, or when the company is floated on a stockmarket via an IPO.

Sale of tokens

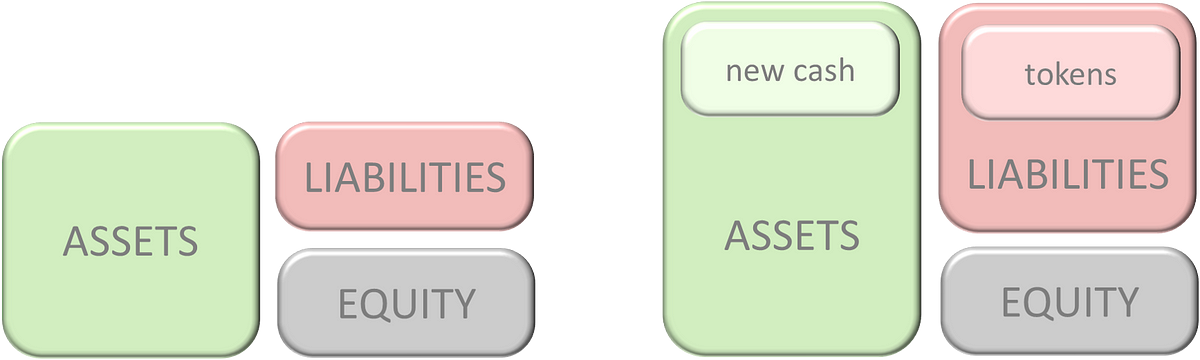

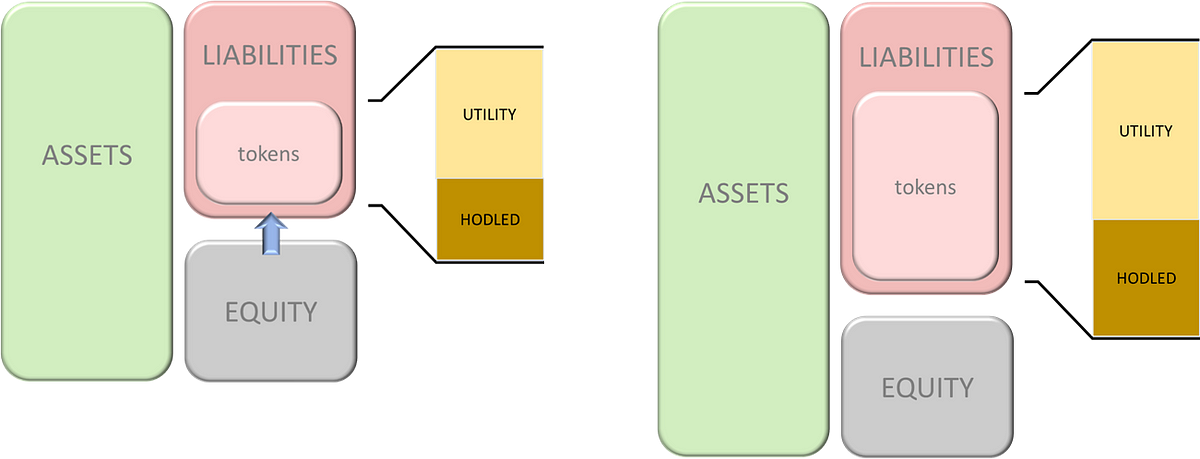

Now consider what happens when a company decides to raise new cash through the sale of tokens instead of selling shares. I have assumed that these are utility tokens, therefore there is a promise that they can (at least in the future) be exchanged for goods or services. This promise represent a liability to the company and can be considered as a form of pre-payment. Thus, the balance sheet of a company after a utility token sale is repesented by the diagram below.

Note that the new cash raised from the sale of the tokens is balanced by the new liability of having been pre-paid for future goods or services. The equity of the company is not altered and there is no dilution (or loss of representation) experienced by existing shareholders. Investors in the company’s utility tokens will not expect to use them all directly in exchange for goods, they expect to sell these when the demand for the tokens increases as more of the company’s goods are sold. This is possible because the tokens are limited in number, and there is an open maket for the sale of these tokens.

Tokens and equity values

Some companies involved in ICOs attach relatively little value to the company equity, and indeed there are ways of forming companies where there are no shareholders and so any increase in company assets (including profit from operating its economy) should in theory be used to increase the token value. In such an arrangement the founders will profit if they own significant tokens — and often they pledged not to sell these immediately.

An attribute of post-ICO companies with low or no equity is that there are often no external stakeholders to influence and assist the management of the company. Whereas, most companies with significant equity will have a board of directors often with experienced non-executives representing the shareholder. This can provide a post-ICO company with a lot of freedom and many companies have a large set of advisors in order to provide this experience and give confidence to the token investors. In companies with smart contract tokens, these can potentially be configured to provide voting rights, so rather than being a utility token they would be a type of equity token.

At the extreme end, a company can be a fully decentralised autonomous organization (DAO) where there is no centralised management and all decisions are made by voting members. This is somewhat ideologically and there there are practical problems associated DAOs. Coindesk’s What is a DAO? gives a simple explanation.

Many, but certainly not all, post-ICO companies or company groups have an equity and token structure — so in a sense they already have a hybrid token-equity stucture. However, few have really considered that these models can be optimised for the stage of the company, and importantly that equity and tokens could be interchanged in either direction. Most tokens issued by ICOs are essentially both a security token (that holds a tradable value) and a utility token (that can be exchanged for goods or services). Strategic Coin has a short article that describes 3 types of token (utility, security and equity).

Investors in tokens are clearly looking for a return on their investment. This value can be increased by two mechanisms, one is speculation and the hodling of tokens in the hope of growth, and this is based on confidence in the second underlying mechanism which is the growth of the company’s utility economy to increase demand for the token. The return on investment is, of course, achieved by the sale of an investors tokens.

Investors in equity are also looking for a return on their investment. This is achieved when the value of their shares increases. Again, the value of the shares can rise by two mechanisms, speculation based on projected revenues and valuations, and also by actual growth in revenue and profits. The return to the investor is achieved when shares are sold in a tradesale of the company, a private share transfer, or through an IPO.

Hybrid equity and tokens model

We have seen a lot of price volatility in cryto-currencies, and also huge token valuations in ICOs where there is still no real utility value for the token. In private equity backed companies we do not see price volatility (because there is very little liquidity in private shares). We can observe it (to a lesser extent) in public companies where there is liquidity but the companies are more mature and have established a ‘real’ value through revenue growth. In general, the overvaluation of assets, and price instability is unhealth for any company especially in the longer-term.

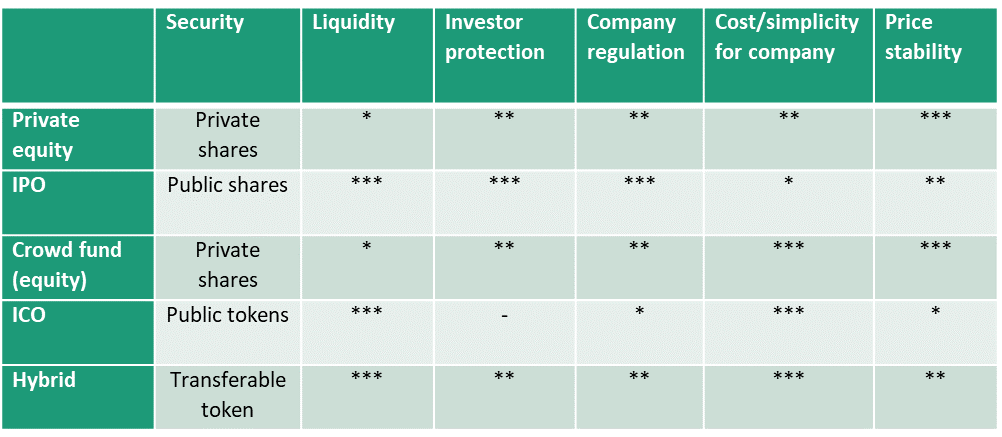

In private companies the equity is generally locked until an exit event, so this is good for stability but not great for many investors. It also means that by taking equity investment, the company is generally commiting to a tradesale or IPO. However, in the case of an ICO that is not the case. We have therefore considered if the benefits of ICOs and private equity fundraising can be combined to give the best of both worlds, without the major pitfalls. In the previous article I presented a table with the different types fundraising and their pros and cons. Here I present the same table extended to show also the hybrid equity-token sale model.

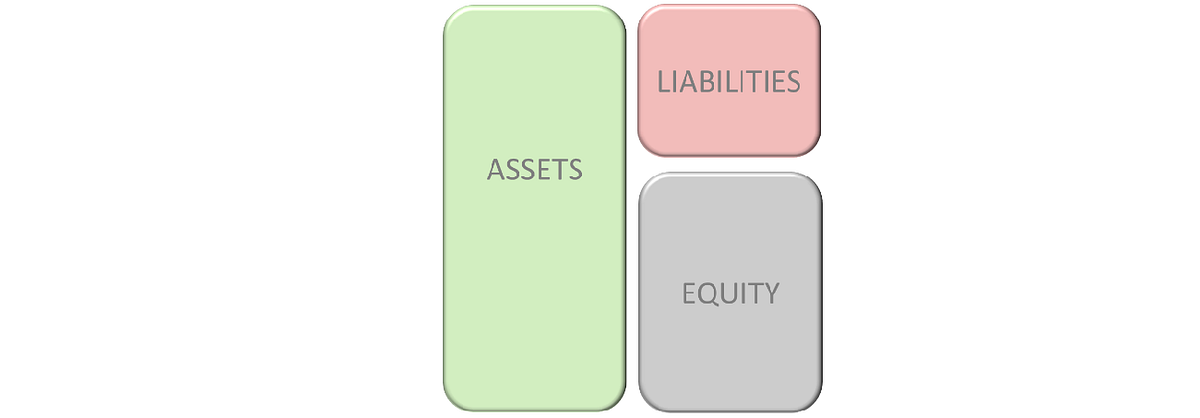

The model suggested is based on the ability to convert equity into tokens, when prudent, to control price volatility and create liquidity for investors. If we consider a start-up technology company that initially has private equity providing good protection to investors. At this stage there is no utility value being offered to customers and so no utility tokens are required.

The balance sheet may look like this with a fair amount of equity having been issued to shareholder. This provides the company with cash to build its technology and thus deliver the service to customers. Once this service has been established, a utility token can be issued by the company in exchange for equity. This effectively is the company buying back equity, and the shareholders wishing to do this exchange will have tokens that can be hodled, sold or use to buy services. Additional tokens can also be released in stages during token sales until all of the minted didgital tokens have been issued.

Since the company knows the level of utility in its economy as it grows, it has a measure of the demand for tokens. It can then control the number of tokens in circulation and heavily influence the number of tokens being hodled. A large proportion of hodled speculation tokens can lead to large price fluctuations since buying and selling activity is dominated short-term price considerations rather than utility value.

A gradual release of tokens according to the utility value of the economy allows it to grow smoothly without the extreme volatility. The investors get liquidity, but with prices related to the performance and growth of the company. The company can raise money using the issue of equity, and later when it has a utility economny it can also raise money but releasing pre-minted tokens.

The company also has two mechanisms to reduce the number of tokens in circulation. It may retain some of the tokens that circulate through its economy (i.e. it reduces the money supply) but must have the cash reserves to be able to do this. Alternatively, it can offer equity in exchange for tokens (either directly or by selling new equity and using the proceeds to limit the tokens in circulation).

An analogy to using tokens and equity to stabilise the companies economy is to consider the instruments used by governments and banks to stabilise national economies. i.e. throught adjustments to the money supply as well as the issue of securities as debt instruments.

Conclusion

I have shown how equity and tokens relate to each other in companies that have both. I have also shown that is it possible to use both equity and tokens to good effect in a company’s economy and that they don’t have to be mutually exclusive. Hopefully, it has helped dispel some of the myths about token backed companies — there are many more so I may write a ‘Myth Buster’ article about token sales soon.

The post The relationship between shares and tokens appeared first on Trisent.